Last Updated August 26th, 2024

Summary

- Canada’s two major railroads Canada National and Canadian Pacific Kansas City resumed labor on August 26th after a forced binding arbitration.

- Origin railyard dwell saw a 200% increase on the 23rd of August because of the strike.

- Destination railyard dwell saw over 1000% increase in wait times, but this recovered rapidly, only staying at those levels for 1 day.

- Average rail transit times increased by 28% due to the strike, but have since returned to normal levels.

- Truckload on-time performance has not seen impacts due to the rail strike.

Canadian National Rail Line and Canadian Pacific Kansas City

Ongoing disputes over safety, scheduling practices, and relocation notices between the Teamsters and rail operators have come to a head. Early in the morning on August 22nd, Canadian National Rail Line (CN) and Canadian Pacific Kansas City (CPKC) locked out workers. These two companies account for an estimated 90-95% of all rail shipments in Canada, meaning the dispute could have wide-reaching impacts on supply chains throughout North America. Some of the most affected industries include mining, forestry, agriculture, automotive, consumer goods, and manufacturing, though the impacts are expected to be widespread.

Based on the wide scope of the strike, the Canada Industrial Relations Board and the labor minister, Steven MacKinnon, ordered operations to resume and imposed binding arbitration between the Teamsters and the railway companies. The Teamsters plan to appeal the ruling in federal court, but in the meantime, they have agreed to resume work and both railroads are operational as of Monday. Although workers are returning to work, tensions remain high between the union workers and railroad companies, which could result in less efficient work and a drop in service levels. project44 will continue to monitor key metrics for rail in Canada.

Rail Metrics

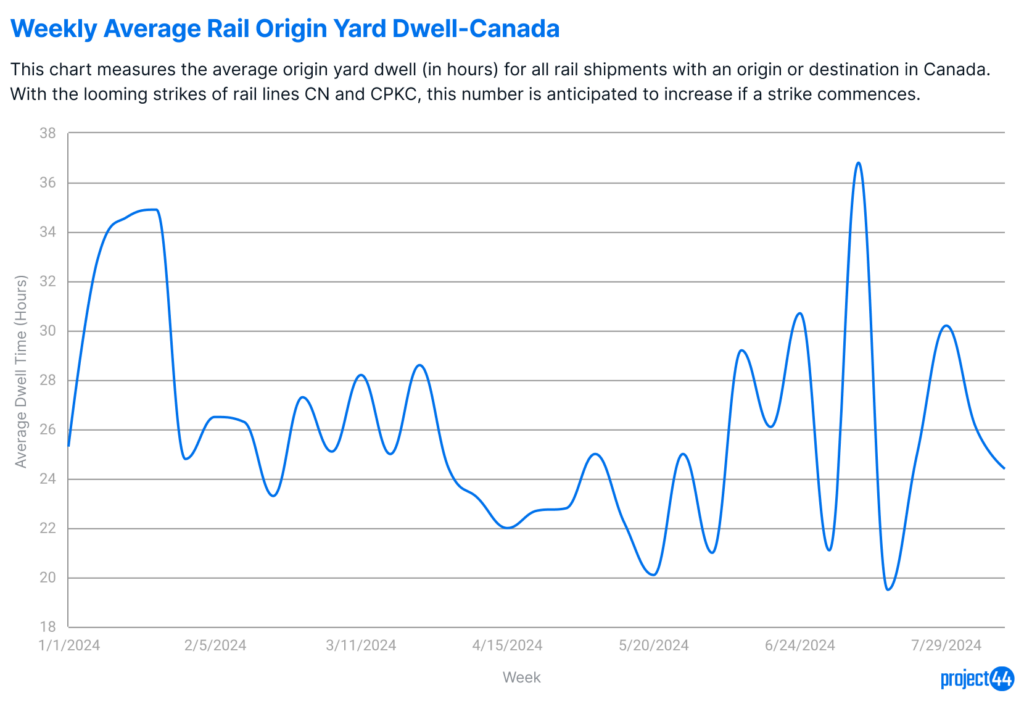

Origin Yard Dwell

The chart below shows the average time in hours that freight is waiting at its origin rail yard.

Average wait times typically vary between approximately 1-1.5 days. Though there was an increase of approximately 8 hours during the week beginning on August 19th, the overall impact on a weekly basis was not major.

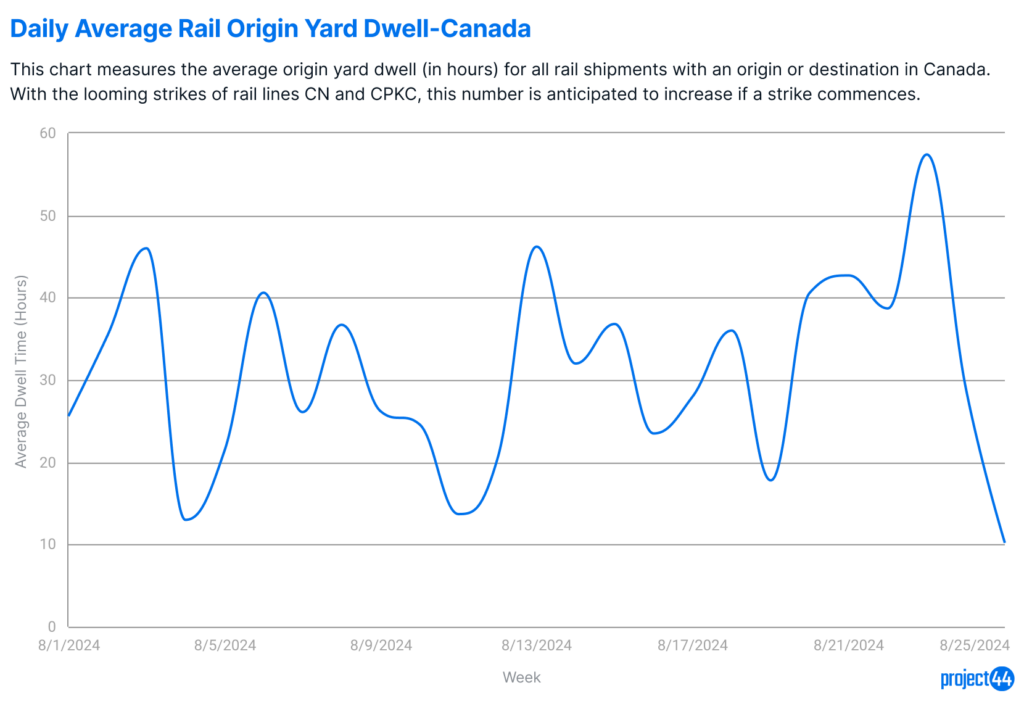

Below, the chart drills down on this metric at a daily level for the month of August.

Here, we can see that after the strike began, there was a high of almost 60 hours of dwell time in origin yards, which was a 200% increase in dwell on August 23rd compared to the 19th. This has been decreasing since August 24th, with the average dwell for the 25th being only 10 hours. With rail resuming on Monday the 26th, this number may increase throughout the week as freight that has been sitting gets loaded.

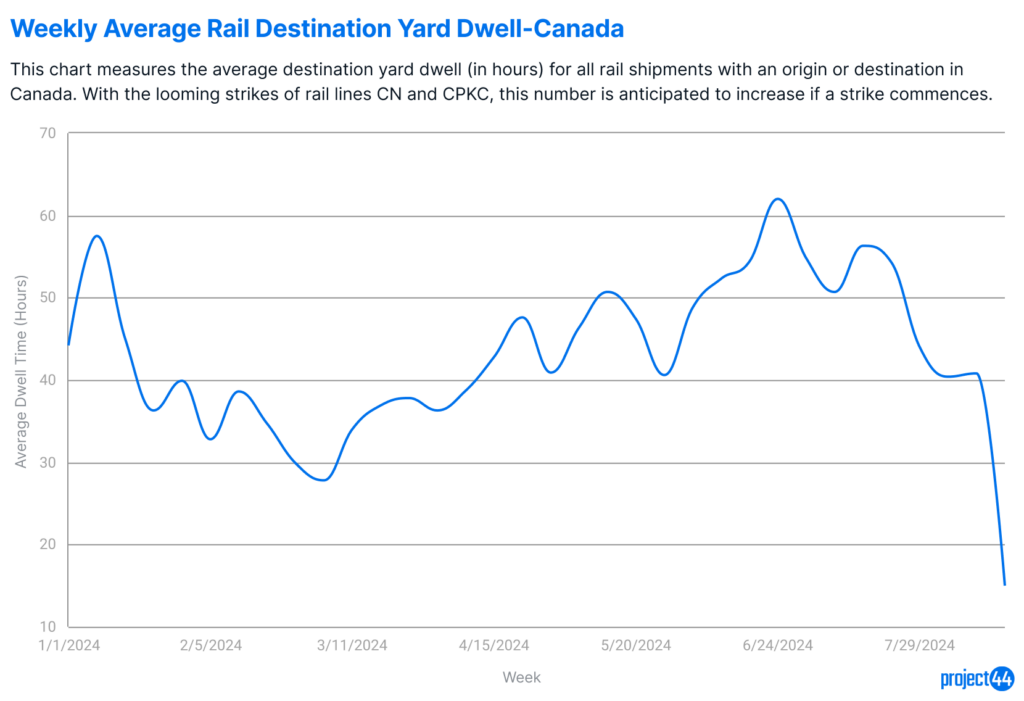

Destination Yard Dwell

The chart below shows the average time in hours that freight is waiting at its destination rail yard.

Average wait times usually range between 1-2.5 days. Despite the strike, dwell at destination yards is down for the week of August 19th. This will continue to be monitored closely as it is possible that this means fewer shipments have arrived and gated out at their final destinations, so it is possible to see impacts from the strike later this week.

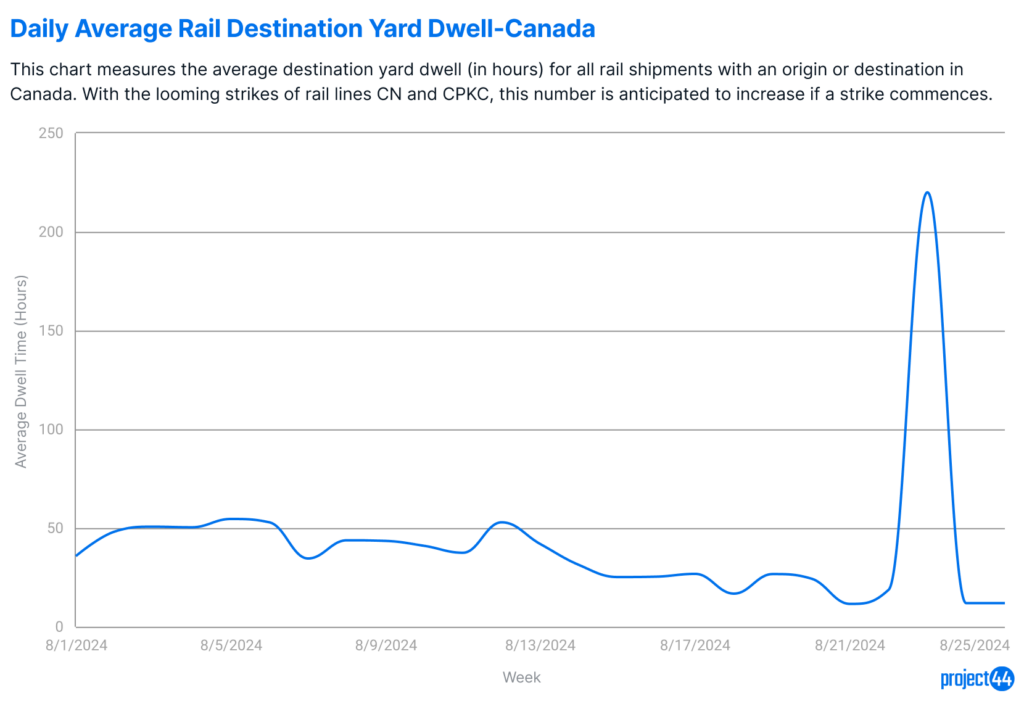

The chart below shows this same metric on a daily level.

The chart shows a major spike on August 23rd, which is the day some railroads resumed operations. Here we see over 1000% increase in dwell time, but this did immediately return to normal levels the following day.

Rail Transit Times

The chart below shows the average transit time for rail shipments to reach their destination.

In the past few weeks, there had already been an upward trend in transit time, though despite the strike, this has continued to decrease in the last 2 weeks.

The chart below drills down to average transit time at a daily level.

Between August 22nd and 23rd, transit time saw a 28% increase in average transit time but has since decreased to more typical levels.

Full Truckload On-Time Performance

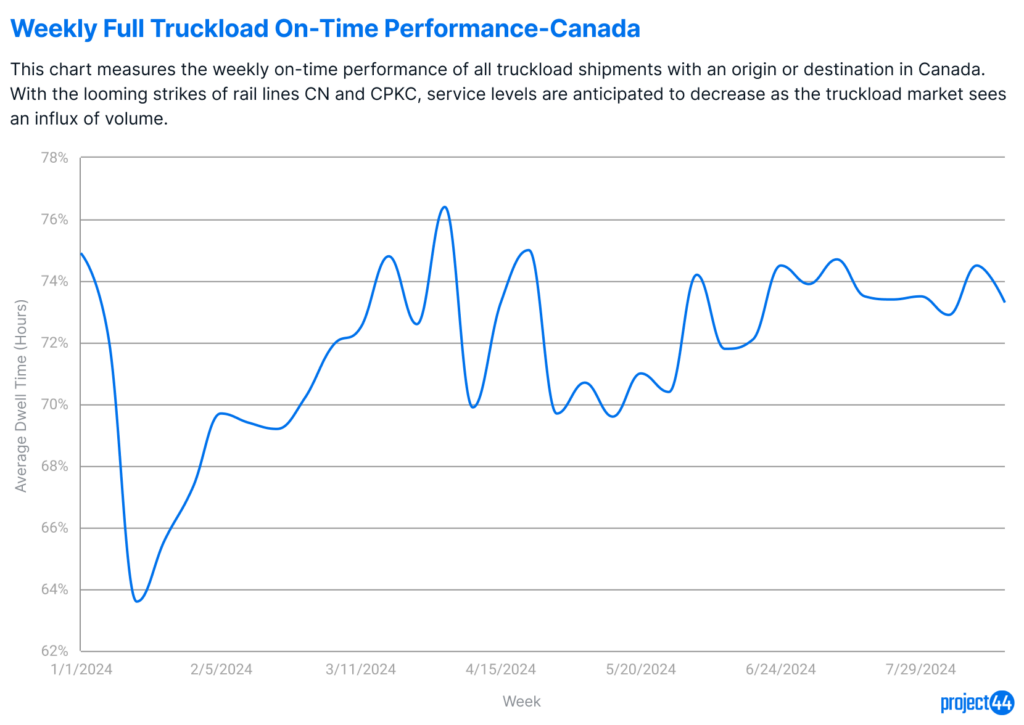

The chart below shows truckload on-time performance for all shipments picked up or delivered to Canada. Although rail workers were striking, the influx in demand for truckload to subsidize the lack of rail could have caused performance levels to drop.

Despite the strike, truckload performance has not been impacted by the rail interruptions. Unless there are further developments , the truckload market is unlikely to see major disruptions.

Industries Most Susceptible to Impacts

Although the strikes have ended, there are lingering tensions between labor and railroads. This could result in slow downs and less efficient work. The following industries are most susceptible to interruptions in rail services.

Crude Oil and Petroleum Products

Crude oil is a key product transported by rail, especially from landlocked regions like Alberta, where pipelines may not reach. Each rail car can carry about 700 barrels of oil, equivalent to the capacity of several tanker trucks. Refined petroleum products such as gasoline and diesel also rely on rail for efficient distribution to markets. With the rail strike, oil producers will face challenges moving large volumes, leading to increased reliance on trucking, which is less efficient and more costly. This could cause supply chain disruptions and potential price hikes in energy markets.

Minerals and Metals

Canada’s vast mineral resources, including coal, iron ore, and potash, are primarily moved by rail due to their heavy weight and bulk. A single rail car can carry around 100 tons of iron ore or coal, making rail transport far more efficient than trucking. Rail disruptions will force mining companies to find alternative, more expensive transportation methods, such as trucks, which cannot match the volume and efficiency of rail. This shift will increase shipping costs, potentially affecting global supply chains, especially in steel production and agriculture, where these materials are essential.

Lumber and Forestry Products

Lumber and other forestry products like logs and pulpwood are traditionally transported by rail because of their large volume and bulk. Rail cars can carry a significant amount of timber, which would require multiple trucks to match. The rail strike means that forestry companies will need to shift to less efficient methods like trucking, leading to higher transportation costs and potential delays. This could impact industries dependent on these materials, such as construction and paper manufacturing, by driving up prices and causing supply shortages.

Automobiles and Parts

The automotive industry heavily relies on rail to transport finished vehicles from manufacturing plants to dealerships across North America. Each rail car can hold multiple vehicles, making rail transport far more efficient than using individual trucks. In addition to finished vehicles, rail is also used to move large volumes of automotive parts necessary for assembly. The rail strike will disrupt these supply chains, forcing manufacturers and distributors to depend on less efficient shipping methods like trucking, leading to increased costs, potential production slowdowns, and delays in vehicle availability.

Intermodal Containers

Intermodal containers, which carry a wide variety of goods ranging from electronics to clothing, are typically shipped by rail due to the efficiency of moving large volumes over long distances. Rail transport allows for containers to be stacked and moved in bulk, something that would require many trucks to achieve the same capacity. With peak season just around the corner, the rail strike will necessitate a shift to truck transport to ensure timely delivery, increasing costs and still causing potential delays in the delivery of consumer goods. Retailers and manufacturers could face disruptions in their supply chains, leading to shortages and higher prices for consumers. As Black Friday, Cyber Monday, and other holiday shopping deals approach, the increased costs in transportation could cause retailers to limit the amount of deep discounts given in order to recoup the loss.

Summary

The rail strike involving Canadian National Rail Line (CN) and Canadian Pacific Kansas City (CPKC) was poised to significantly disrupt supply chains across North America. Operations were resumed on Monday the 26th after forced binding arbitration. The strike had led to a significant increase in origin railyard dwell times, spiking by 200% on August 23rd. Destination railyard dwell times also surged by over 1000% on the same day but quickly returned to normal. Rail transit times increased by 28% due to the strike but have since normalized. Truckload on-time performance remained unaffected by the rail strike.

Despite the resumption of work, tensions between the Teamsters and the rail operators remain high, potentially affecting service levels. Key industries such as crude oil, minerals, lumber, automobiles, and intermodal containers, heavily reliant on rail transport, are vulnerable to disruptions and may experience increased costs and delays as they shift to alternative transportation methods.